Need a financial boost or looking for extra cash? Don’t worry: the solution is here. Meet Manulife Bank: a Canadian online bank with numerous financial product options for both businesses and individuals. These include all-in-one bank accounts, high-interest savings accounts, and credit cards. But it also offers other products, such as investments, mortgages (including Manulife One), and personal loans. Manulife Bank of Canada, a subsidiary of Manulife, is a federally chartered online bank founded in 1993, making it a company with over two decades of history and entirely online, with a wide range of financial products available to help you in your daily life and make your money grow. We’ll tell you all about Manulife Bank’s personal loans and much more in this post. Ready? Let’s go!

Meet Manulife Bank of Canada

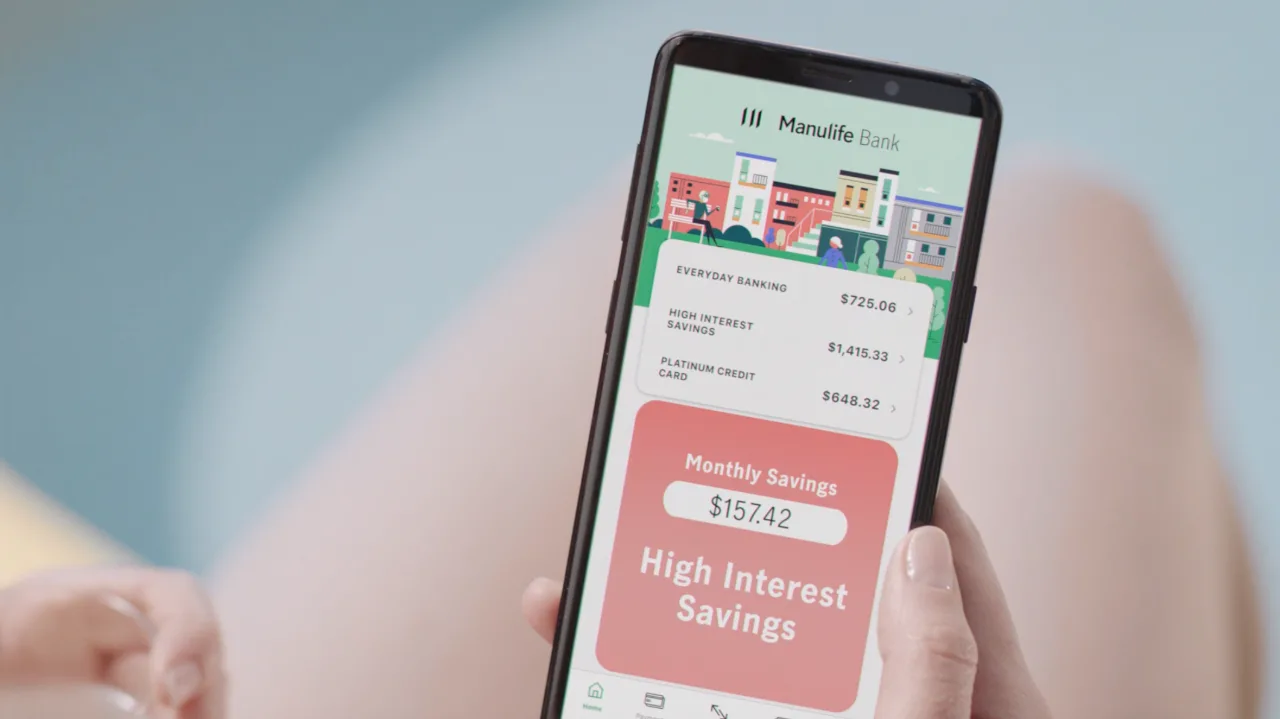

Manulife Bank has no physical branches; it’s a fully digital financial institution. As a method of operation, it distributes its financial products and services through independent financial advisors and brokers. Customers can then access their accounts via online services and the mobile application, as well as using THE EXCHANGE network ATMs, at no extra cost. With numerous products including chequing accounts, high-interest savings accounts, credit cards, investments, and mortgages, the bank is a member of CDIC (Canada Deposit Insurance Corporation), so deposits in their savings products (savings accounts, GICs, etc.) are eligible for deposit insurance. The functionality of Manulife Bank’s products also extends to its credit lines and loan types available through the financial institution.

Manulife Bank of Canada Line of Credit

When you have a major expense, it’s good to know you have access to money to pay for it, right? After all, no one likes unexpected events or canceling plans. Therefore, with Manulife Bank, once you’ve set it up, a line of credit is always available. Through it, you can borrow up to your limit at a competitive interest rate to buy a new sofa or major appliance, repair a furnace or roof, or pay off your credit card balances and other higher interest rate loans. A line of credit is available with a credit limit of $25,000 to $100,000. This method is ideal for those who have investments or permanent life insurance to secure their line of credit, or have enough income to make their loan payments. If you need more borrowing room, there’s also the option of Access Line of Credit Plus – with even higher credit limits. Through the Line of Credit, you can:

- Access your money and manage your account 24/7.

- Make interest-only or interest-plus-principal payments.

- Pay back lump sums whenever you want.

A secured line of credit, like the Access Line of Credit and Access Line of Credit Plus offered by Manulife Bank of Canada, is guaranteed by assets you own, such as investments or permanent life insurance. If you default on your loan, your investments or life insurance will pay it off for you. The advantage of a secured line of credit is that it generally offers a significantly lower interest rate than an unsecured line of credit. You can lower your limit at any time with a simple letter of direction – a letter that instructs Manulife Bank to lower your credit limit. However, to increase your limit, you have to apply for the extra borrowing room. However, the financial institution also works with two other distinct types of loans: the RRSP loan – where you make a bigger RRSP contribution to get more money working for you today – and the Investment loan – where you can use a loan to boost compound returns and create wealth in a non-registered account.

Become a customer today and enjoy!

Creating an account is quick and easy. In just a few steps, you can make transactions and check the availability of your line of credit from Manulife Bank of Canada and enjoy all the benefits this modality brings you. Below, we’ll explain the step-by-step process for you to take advantage of the opportunities and start transforming your financial life right now! Click the button below to be redirected and learn more.