When unexpected expenses pile up and bills start to weigh heavily, finding fast and reliable financial support becomes crucial. The iCash Loan offers a simple, accessible solution designed to help you regain control over your budget without the usual hurdles. Whether you’re dealing with irregular income or a low credit score, this loan provides a practical way to manage urgent payments and bring stability back to your finances. Let’s explore how this loan can be the lifeline you need when every dollar counts.

What is the iCash Loan and How Does It Work?

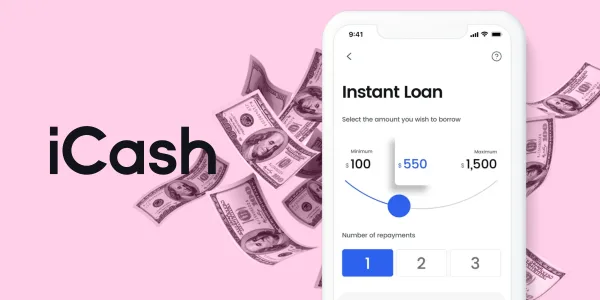

Before choosing any financial product, it’s essential to understand how it works and what makes it different from traditional options. The iCash Loan is a short-term, fully digital personal loan tailored for people who need fast access to money—especially when banks and credit cards aren’t an option. It’s known for its user-friendly process and flexible repayment terms that accommodate different income levels and financial situations. iCash operates entirely online, allowing applicants to request a loan from the comfort of their homes. The application process takes only a few minutes, with decisions made in real-time. Once approved, the funds are deposited directly into your account—often within the same day. Unlike traditional loans, there’s no need for extensive paperwork, in-person meetings, or long waits for approval. This makes the iCash Loan ideal for anyone needing a quick financial boost to cover essential expenses like rent, bills, or urgent purchases. It’s a streamlined solution built to match the pace and pressure of real life.

Benefits of the iCash Loan

When you’re navigating a tight financial situation, the last thing you need is a complex loan process or high-interest traps. That’s where the iCash Loan stands out—offering a range of benefits designed to ease financial pressure and help you move forward with confidence. Time matters when you’re facing overdue bills or unexpected costs. iCash offers real-time approval decisions, and in many cases, approved funds are transferred within hours. No long waits, no unnecessary delays. Besides that, Traditional banks often deny applications based solely on your credit history. iCash takes a different approach, considering your current financial situation rather than just your score. This opens the door for more people to access funds when they need them most.

Another important point is there are no hidden fees with iCash. You’ll know exactly what you’re agreeing to from the start, with clear repayment terms and competitive interest rates. This level of transparency allows for better planning and peace of mind. iCash lets you choose repayment schedules that align with your income and lifestyle, helping you manage debt without added stress. Whether you’re looking to cover a sudden emergency or just need a short-term boost, these benefits make the iCash Loan a smart, supportive option to restore your financial stability.

How much can I borrow with iCash?

Loan amounts typically range from $100 to $1,500, depending on your financial profile and repayment capacity. Returning customers may qualify for higher amounts based on positive repayment history. Once approved, funds are usually deposited within minutes. iCash uses e-Transfer technology to ensure rapid delivery, so you can access your money almost immediately.

Ready to apply?

When you’re facing urgent expenses and traditional credit options seem out of reach, the iCash Loan emerges as a practical and empowering solution. With its fast approval process, flexible repayment terms, and accessibility even for those with less-than-perfect credit, iCash helps you regain control of your finances without added stress or delay. Whether you need to cover late bills, handle unexpected repairs, or simply create breathing room in your budget, iCash offers a straightforward path to relief.