Unexpected events happen, just as things don’t always go as planned, right? Sometimes, we need a little help to achieve a dream, pay an extra bill, or even handle a last-minute expense. Money when you need it, for as long as you need it: that’s how the Manulife Bank line of credit works! If you’re looking for some extra income to achieve your goals, the Manulife Bank Access Line of Credit is available with a credit limit of $25,000 to $100,000, while the Access Line of Credit Plus has an available credit limit of $100,000 plus. If you’re already a client and want to learn more, or if you want to open an account at Manulife Bank to get the line of credit, you’ve come to the right place! We’ll explain how you can access yours in detail in this post, as well as the eligibility criteria and much more! Let’s go.

How does the Manulife Bank Line of Credit work?

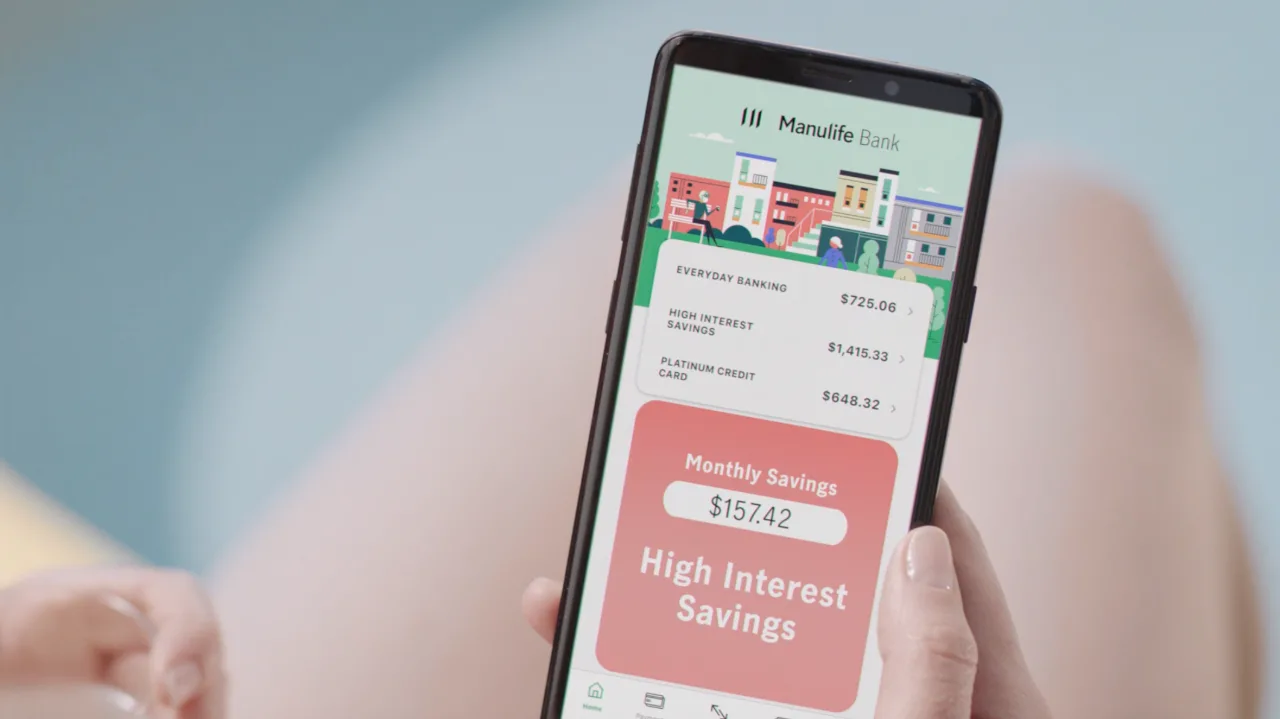

The Manulife Bank Access Line of Credit allows you to borrow up to your limit at a competitive interest rate to buy a new sofa or major appliance, repair a furnace or roof, or pay off your credit card balances and other higher interest rate loans. A line of credit can be a flexible, low-cost way to access cash or reduce the cost of existing loans. You get better interest rates because your Access Line of Credit is secured by assets you own, such as Manulife segregated funds, mutual funds, GICs, and deposit accounts; Manulife permanent life insurance plans with a cash surrender value; or whole life insurance with a cash surrender value from BMO Life, Canada Life, Empire Life, Equitable Life, Great-West Life, Industrial Alliance, Ivari, London Life, RBC Insurance, or Sun Life. You can withdraw money from your Access Line of Credit using ATMs, direct (debit) payments, and cheques, and you can set up pre-authorized payments to and from your account. Manage your account online, through the Manulife Bank mobile app, and by telephone.

What are the criteria for having an Access Line of Credit?

To open a Manulife Bank line of credit, you’ll need to speak to your advisor about getting a Manulife Bank Line of Credit. You can search for the one closest to you on the institution’s website or through the available contact channels if you don’t already have one. In general, you need to have an active account at the bank, after all, the line of credit can be secured with investments or permanent life insurance. To open an account with Manulife Bank, you’ll need to provide your Social Insurance Number (SIN), a government-issued photo ID, and a valid email address. You can also use your login credentials from another Canadian financial institution. But be aware: these are the data for opening an account, and it’s recommended that you have the help of an advisor to carry out all the necessary steps. The Access Line of Credit is perfect for you if:

- You have investments or permanent life insurance to secure your line of credit.

- You have enough income to make your loan payments.

- You want access to borrowed money that costs nothing until you use it.

Ready to apply for yours?

Start changing your life today with a Manulife Bank Access Line of Credit. From the moment of application, an advisor will explain and advise you on everything you need to know to make informed decisions and open your account safely and transparently. Don’t worry: at every step, you’ll have all the necessary support. Click the button below and start a new financial journey with Manulife Bank of Canada!